s corp tax calculator nj

This calculator helps you estimate your potential savings. NJ State Average Bronze Premium.

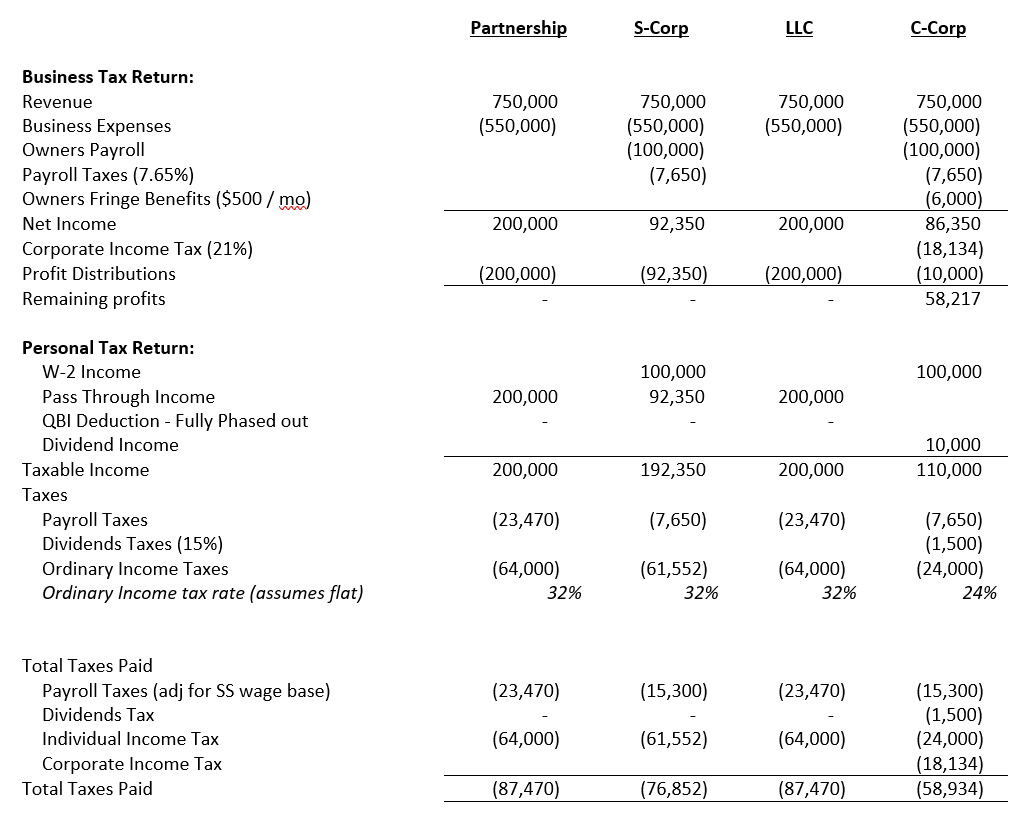

S Corp Vs Llc Everything You Need To Know

Licensed Professional Fees.

. Estimated Local Business tax. New jersey state tax quick facts. Annual state LLC S-Corp registration fees.

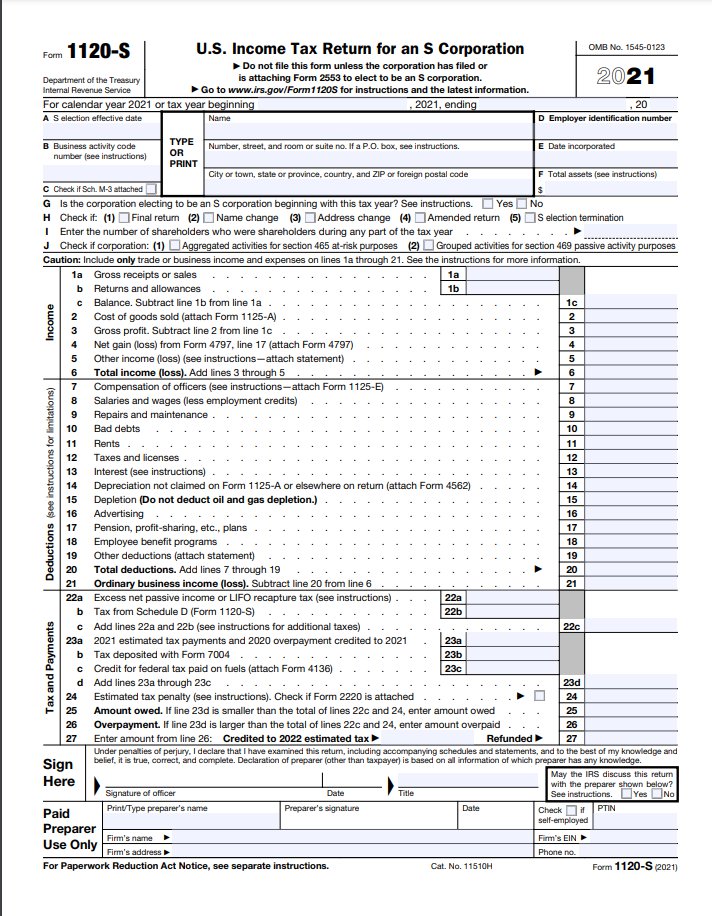

Fill out for any. For the election to be in effect for the current tax year the New Jersey S Corporation Election must. For more information see the section on Net Gains or Income From Disposition of Property in the New Jersey Income Tax return instructions.

Annual cost of administering a payroll. Worksheet for calculating household income. Forming an S-corporation can help save taxes.

Nonprofit and Exempt Organizations. Youre guaranteed only one deduction here effectively. New jersey state tax quick facts.

The tax rate on net pro rata share of S corporation income allocated to New Jersey for non-consenting shareholders for tax year 2010 periods beginning 809 through 1209 is 1075. From the authors of Limited Liability Companies for Dummies. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses.

10 -New Jersey Corporate Income Tax Brackets. AS a sole proprietor Self Employment Taxes paid as a Sole. We are not the biggest.

For example if you have a. File a New Jersey S Corporation Election using the online SCORP application. New Jersey has a flat corporate income tax rate of 9000 of gross.

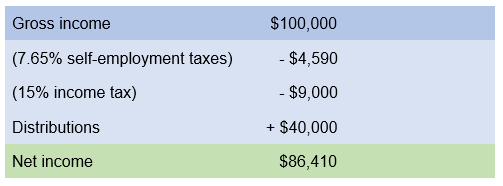

As a sole proprietor you would pay self-employment tax on the full 90000 90000 x 153 13770. Pass-Through Business Alternative Income Tax PTE S Corporations Are Responsible for Payment Of New. Enter the number of full months you resided in NJ.

Overview of New Jersey Taxes. This marginal tax rate means that. If you make 70000 a year living in the region of New Jersey USA you will be taxed 12783.

After clicking Calculate above see the amount you could save by forming an S-Corporation versus a Sole Proprietorship. The state income tax rate in New Jersey is progressive and ranges from 14 to 1075 while federal income tax rates range from 10 to 37 depending on your income. The S Corporation tax calculator below lets you choose how much to withdraw from your business each year and how much of it you will take.

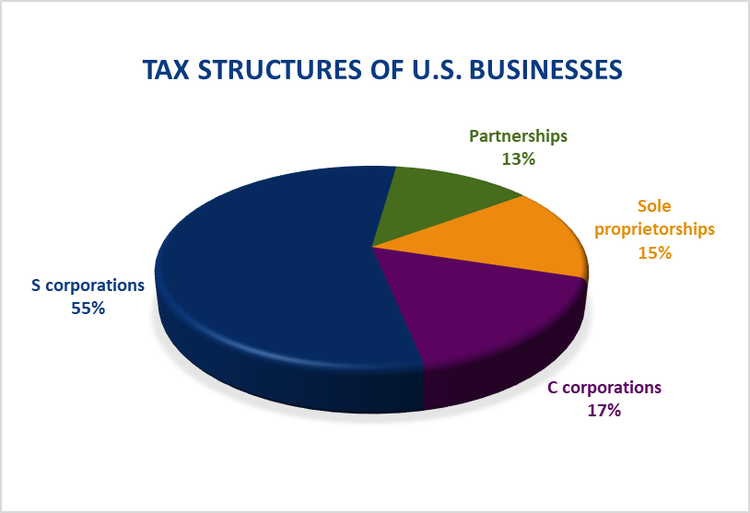

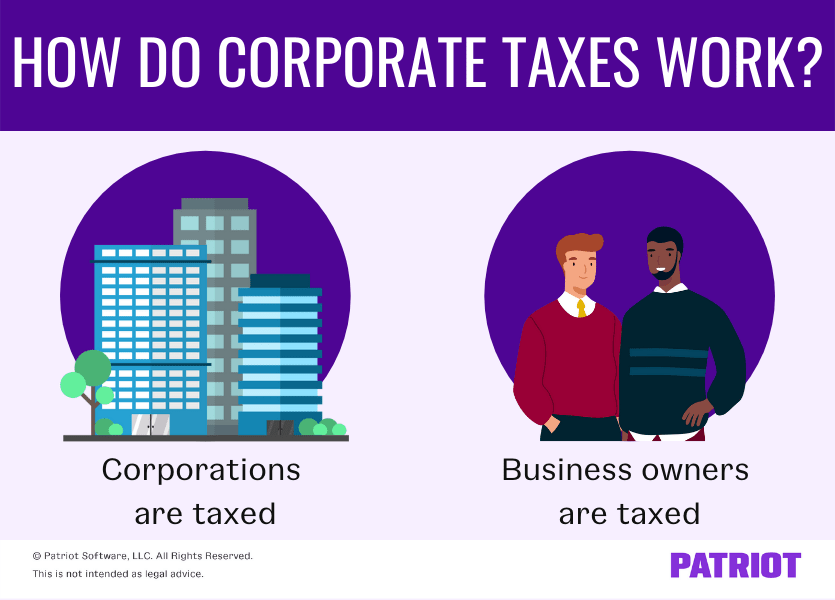

Your business earns 100k in revenue and has 50k in business expenses thats a 50k profit on your form Schedule C. An S corporation S Corp Subchapter S corporation under the IRS code is not taxed at the business level because it is a pass-through tax status for federal state and local. New jersey income tax calculator 2021.

Your average tax rate is 1198 and your marginal tax rate is 22. Tax Bracket gross taxable income Tax Rate 100000. But as an S corporation you would only owe self-employment tax on the 60000 in.

The rates which vary depending on income level and filing status range from 140 to 1075. Total first year cost of S-Corp administration. More information on calculating the New Jersey.

The Garden State has a progressive income tax system. As noted above a new jersey s corporation pays a reduced tax rate.

New York Hourly Paycheck Calculator Gusto

Tax Savings Calculator For Llc Vs S Corp Gusto

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Tax Liability What It Is And How To Calculate It Bench Accounting

Tax Calculator Return Refund Estimator 2022 2023 H R Block

S Corp Vs C Corp Which Is Right For Your Small Business

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Llc And S Corporation Income Tax Example Tax Hack

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

What Is Double Taxation For C Corps The Exciting Secrets Of Pass Through Entities Guidant

New Jersey Nj Tax Rate H R Block

20 Qbi Deduction Calculator For 2021

S Corporation Tax Filing Benefits Deadlines And How To Bench Accounting

Free Llc Tax Calculator How To File Llc Taxes Embroker

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Free Llc Tax Calculator How To File Llc Taxes Embroker

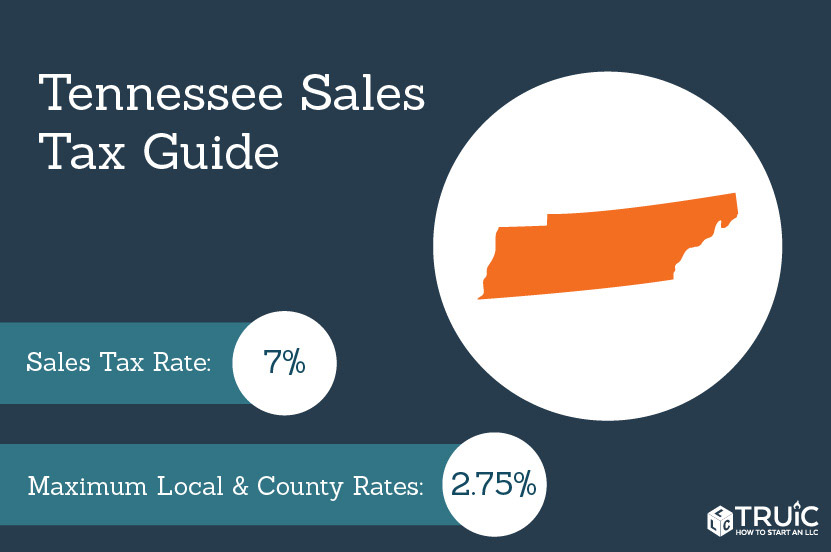

Tennessee Sales Tax Small Business Guide Truic